Introduction: Importance of Property Distribution in Muslim Law

The Indian Muslim law for property distribution plays a vital role in ensuring that heirs receive their rightful share of inheritance after the death of a family member. Unlike Hindu succession, which relies on the concept of coparcenary, Muslim inheritance is governed by religious principles rooted in the Quran, Hadith, and Islamic jurisprudence (Fiqh). These rules are binding in India under the Muslim Personal Law (Shariat) Application Act, 1937.

Property distribution in Islam is based on clear and predetermined shares for heirs. It is considered both a legal duty and a religious obligation. The system ensures justice by granting every eligible heir a specific portion, leaving little scope for arbitrary exclusion or favoritism. This makes Muslim inheritance law one of the most detailed and structured systems of succession.

Foundation of Muslim Inheritance Law

Legal Excellence

📜

1937

Muslim Personal Law (Shariat) Application Act Year

⚖️

1/3

Maximum Estate Portion That Can Be Willed Away

👥

2:1

General Ratio of Son to Daughter Inheritance Share

📚

4 Sources

Quran, Sunnah, Ijma, Qiyas - Foundations of Muslim Law

Sources of Indian Muslim Law for Property Distribution

Unlike Hindu or Christian succession systems, Muslim inheritance law does not rely on statutory codification in India. Instead, it is primarily derived from religious texts and customs. The Indian Muslim law for property distribution acknowledges the following sources:

Quran

The holy Quran lays down explicit shares for heirs like daughters, sons, spouses, and parents

Importance: Primary source with divine authority

Sunnah (Hadith)

Traditions and sayings of Prophet Muhammad (peace be upon him) that clarify inheritance rules

Importance: Secondary source providing practical guidance

Ijma

Consensus of Islamic scholars on matters not directly addressed in Quran or Hadith

Importance: Scholarly consensus for complex issues

Qiyas

Analogical reasoning applied to derive rulings in new situations

Importance: Logical extension for modern scenarios

In India, the Muslim Personal Law (Shariat) Application Act, 1937 gives these religious principles legal force. Thus, whenever a Muslim dies intestate (without a will), property is distributed according to these rules.

It is important to note that wills under Muslim law are restricted. A Muslim can only will away up to one-third of their estate without the consent of heirs. The rest must follow the mandatory distribution rules.

Principles of Property Inheritance in Islam

Inheritance in Islam is based on justice and fairness. The Indian Muslim law for property distribution follows certain key principles that ensure wealth is shared equitably after death:

Core Principles of Islamic Inheritance

This structured system minimizes disputes and ensures that family wealth does not remain concentrated in the hands of a few. It also protects the financial security of women and children, making Islamic inheritance one of the most detailed succession frameworks in the world.

Islamic Law for Property Distribution for Daughter

A crucial aspect of Indian Muslim law for property distribution is the share given to daughters. Unlike older patriarchal systems, Islam recognizes daughters as rightful heirs. Their shares are clearly specified in the Quran, ensuring they are not excluded.

Single Daughter (no son)

1/2 of the estateCondition: When there is only one daughter and no son

Example: In ₹10 lakh estate, daughter gets ₹5 lakh

Two or More Daughters (no son)

2/3 of the estate collectivelyCondition: When there are multiple daughters but no son

Example: In ₹12 lakh estate, daughters collectively get ₹8 lakh

Daughter with Son

Half of son's shareCondition: When both sons and daughters exist

Example: If son gets ₹4 lakh, daughter gets ₹2 lakh

"The Quran explicitly protects the rights of daughters, ensuring they are entitled to inheritance regardless of marital status."

This provision ensures that women have financial security. Although a son's share is generally double, the daughter's entitlement is guaranteed and cannot be taken away. Courts in India have repeatedly upheld these principles, emphasizing that Muslim daughters cannot be excluded from inheritance under any custom or family arrangement.

Property Distribution in Islam Calculator

One of the most practical ways to understand Indian Muslim law for property distribution is by using a property distribution in Islam calculator. Since the Quran prescribes fixed shares for heirs, online and offline tools have been developed to help families calculate inheritance quickly.

1

Input Heirs Information

2-3 minutesEnter the number of heirs such as sons, daughters, parents, spouse, and siblings.

2

Apply Islamic Rules

InstantCalculator applies Islamic inheritance rules as per Quran and Hadith automatically.

3

Generate Share Distribution

InstantTool instantly generates the percentage share each heir is entitled to receive.

4

Legal Verification

1-2 weeksWhile calculators are useful, official distribution requires legal verification and documentation.

For example, if a man dies leaving behind a wife, one son, and one daughter, the calculator will show that the wife receives 1/8, while the son gets twice the share of the daughter from the remaining estate.

In India, lawyers specializing in Muslim succession law often use such calculators to ensure quick resolution of disputes. While these tools are useful, official distribution may still require legal verification, affidavits, and mutation of property records.

Muslim Law Property Distribution: Key Rules in India

The Muslim law property distribution system in India is governed by the principles of Sunni and Shia schools of law. While the foundational rules are similar, minor variations exist in the application.

Widow (with children)

1/8 of the estateCondition: When the deceased leaves children

Example: In ₹8 lakh estate, widow gets ₹1 lakh

Widow (no children)

1/4 of the estateCondition: When the deceased has no children

Example: In ₹8 lakh estate, widow gets ₹2 lakh

Widower (with children)

1/4 of the estateCondition: When the deceased wife leaves children

Example: In ₹8 lakh estate, widower gets ₹2 lakh

Unlike Hindu succession, Muslim inheritance does not recognize the concept of joint family property. Instead, each heir's share is individualized and becomes their absolute property immediately after the death of the owner.

This makes the Indian Muslim law for property distribution very structured. It leaves little room for manipulation, ensuring that all heirs, especially women, receive their rightful share.

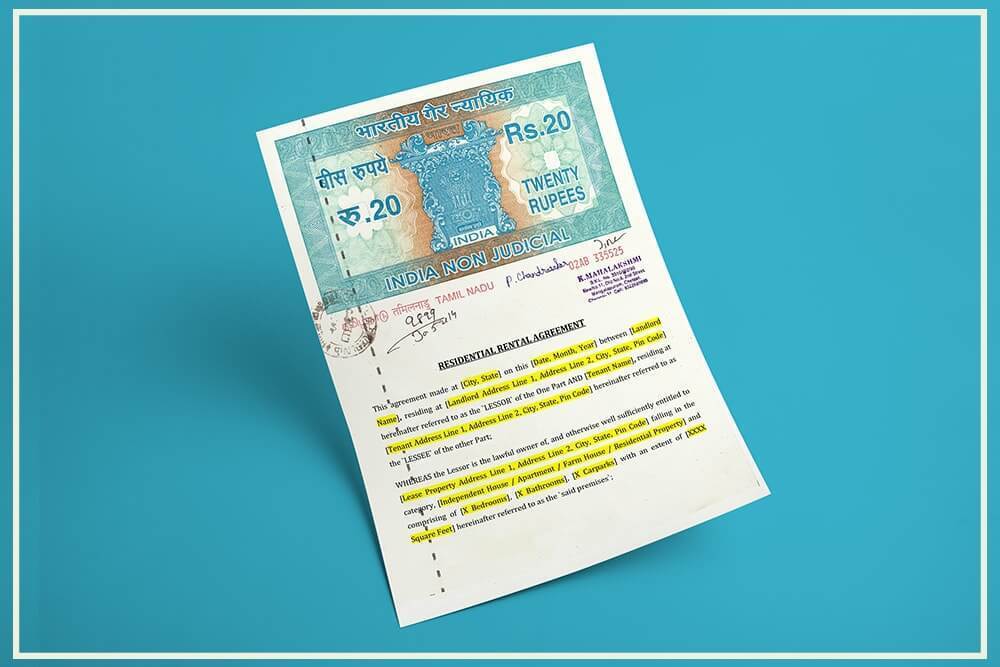

Muslim Property Law in India PDF

Many legal professionals and students search for Muslim property law in India PDF resources for reference. These documents usually contain statutory texts, case laws, and Quranic verses relevant to inheritance distribution.

Key References Found in PDF Guides

Law students and advocates often rely on these PDFs for accurate information. However, PDFs available online should be cross-verified with updated laws and judicial rulings, since property law is subject to ongoing interpretation by Indian courts.

Judicial Interpretation of Muslim Property Rights

Although the Quran specifies clear shares, Indian courts often deal with disputes when families do not follow these rules. The judiciary plays a crucial role in ensuring compliance with the Indian Muslim law for property distribution.

Rashid Ahmad v. Anisa Khatun (1932, Privy Council)

Ruling: Inheritance rights vest immediately upon death and cannot be postponed indefinitely

Significance: Established immediate vesting principle

Mohd. Khan v. Shahmali (Supreme Court of India)

Ruling: Muslim daughters cannot be denied shares, and their entitlement is protected under Shariat law

Significance: Protected daughters' inheritance rights

Delhi High Court Cases

Ruling: Customary practices cannot override the fixed shares laid down in the Quran

Significance: Prioritized religious law over local customs

"Muslim inheritance law in India is not just religious guidance but also enforceable legal principle under the Shariat Act, 1937."

These cases show that while the religious law is clear, families sometimes attempt to bypass daughters or widows. Courts ensure that the law of inheritance under Islam prevails over local customs, securing justice for weaker sections.

Frequently Asked Questions

What is the maximum amount a Muslim can will away without heir consent?

Under Muslim law, a person can only will away up to one-third of their estate without the consent of heirs. The remaining two-thirds must follow the mandatory distribution rules laid down in the Quran.

How much does a daughter inherit compared to a son in Muslim law?

Generally, a daughter receives half the share of a son. For example, if a son gets 2 parts, the daughter gets 1 part. However, daughters have guaranteed inheritance rights that cannot be denied.

Can a Muslim daughter be completely excluded from inheritance?

No, absolutely not. Muslim daughters have guaranteed inheritance rights under Quranic law. Courts in India have repeatedly upheld that daughters cannot be excluded from inheritance under any custom or family arrangement.

What happens if a Muslim dies without a will in India?

When a Muslim dies intestate (without a will) in India, property is distributed according to Islamic inheritance rules as governed by the Muslim Personal Law (Shariat) Application Act, 1937.

How does Muslim inheritance law differ from Hindu succession law?

Muslim inheritance is based on fixed Quranic shares and doesn't recognize joint family property concept. Hindu law relies on coparcenary rights and has been amended to give equal rights to daughters. Both are distinct personal law systems.

Conclusion: Balance of Rights and Duties

The Indian Muslim law for property distribution provides one of the most structured systems of inheritance. Unlike other personal laws, it is based on divine principles enshrined in the Quran and ensures that each eligible heir receives a defined portion. The system emphasizes fairness, justice, and financial security for all family members, particularly women and children.

We have seen how the property distribution in Islam calculator helps in quick understanding, how the Islamic law for property distribution for daughter secures her rights, and how comprehensive Muslim law property distribution prevents arbitrary exclusions.

Ultimately, the balance between rights and responsibilities in Islamic inheritance ensures that wealth circulates justly in society. By respecting these legal frameworks, Indian Muslims can protect the dignity of their families and prevent disputes that often arise from unclear succession.

Key takeaway: The law cannot be bent by custom or convenience. Every heir, whether son or daughter, parent or spouse, has a rightful share. The legal system in India ensures that these principles are upheld through the Shariat Act, 1937, and the judgments of the courts.

Need Help? We're Just a Click Away

If you are facing disputes under Muslim inheritance law, or need guidance on distribution of property among heirs, talk to JuriGram today. Our expert property lawyers will assess your case, apply the Shariat rules, and help you secure your rightful share.