Introduction: Understanding the Gujarat Stamp Duty Notification

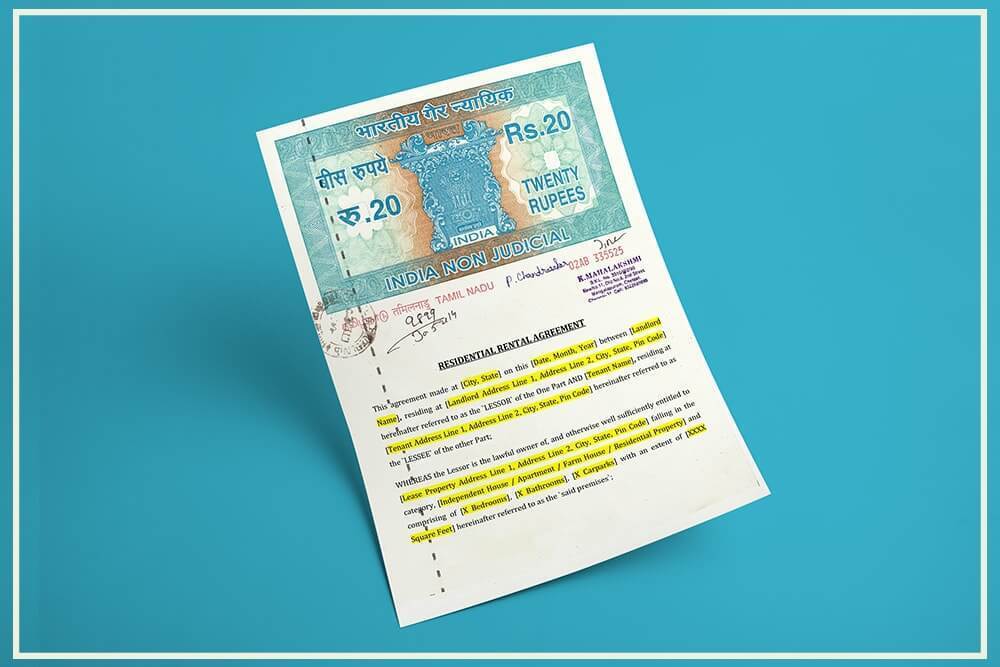

The Gujarat stamp duty notification is the State's official update that prescribes stamp duty payable on instruments such as sale deeds, gift deeds, conveyances, partitions, mortgages, leases, and powers of attorney. Each notification clarifies rates, procedural changes (like e-stamping), and any temporary or permanent concessions. If you are buying, selling, gifting, or transferring property in Gujarat, this notification directly affects your final payable amount at registration.

Why does this matter? Two reasons: First, a document that is not duly stamped is typically inadmissible as evidence until the deficit duty and penalty are paid. Second, stamp duty is computed on a value benchmarked to the government's jantri (ready-reckoner) or the consideration amount—whichever is higher—so even a small misunderstanding can cost you significantly. This guide translates the latest Gujarat stamp duty notification into plain language, with examples, checklists, and links to official resources.

We also explain concessions for women buyers, where to find the Gujarat Stamp Duty Schedule PDF, how to use a Gujarat stamp duty calculator, and what to do if you underpay or need adjudication. Throughout, we link to government pages for cross-checking and compliance. For deeper real-estate due diligence, consider reading our related explainers on title search, encumbrance certificates, and sale agreement drafting.

✅- ✓ Core focus:Practical, step-by-step compliance with the latest Gujarat stamp duty notification

- ✓ Who should read:Homebuyers, sellers, NRI owners, brokers, startup founders acquiring office space, and legal/finance teams

- ✓ Outcome:Understand how to calculate, pay, and document stamp duty correctly, including female concessions and penalties